Ready to Begin Your Journey Toward Financial Freedom?

Our Core Solutions

Wealth Management

A well-balanced portfolio is key to steady growth. We help you design, monitor, and rebalance your investments to ensure consistent performance and long-term stability.

Learn More

Tax Planning

Save more and invest smarter. We help you plan your taxes legally and efficiently by aligning your investments with the latest tax-saving strategies.

Learn More

Loan Against Securities

Unlock the value of your investments without liquidating them. Get easy access to funds using your shares, bonds, or mutual funds as security — while your investments continue to grow.

Learn More

The Wealth Book – Your Personal Financial Dashboard

Understand your complete financial picture at a glance.

With The Wealth Book, we consolidate all your assets — insurance, equity, property, mutual funds, and more — to show you where you stand today and how to reach your wealth potential.

Financial Learning & Awareness

We believe knowledge is the foundation of financial freedom.

Through workshops, webinars, and educational content, we help individuals of all ages understand investing, insurance, and money management — empowering them to make confident, informed decisions.

Goal-Based Financial Planning

Whether it’s buying a home, funding education, or securing retirement, we create customized financial roadmaps to help you reach your life goals with confidence.

Learn More

Loan Against Securities

Unlock the value of your investments without liquidating them. Get easy access to funds using your shares, bonds, or mutual funds as security — while your investments continue to grow.

Learn More

Wealth Management

A well-balanced portfolio is key to steady growth. We help you design, monitor, and rebalance your investments to ensure consistent performance and long-term stability.

Learn More

Tax Planning

Save more and invest smarter. We help you plan your taxes legally and efficiently by aligning your investments with the latest tax-saving strategies.

Learn More

Wealth Planning

Document, measure, and optimize your wealth with strategies that protect, grow, and create freedom.

Coaching That Transforms

One-on-one coaching designed to shift you from working for money to having money work for you. Gain clarity, confidence, and a roadmap to financial independence.

Book a Coaching Session

Our 3-Step Path to Financial Freedom

Financial Planning is a simple three-step process that protects your present, grows your future, and accelerates your wealth. It begins with Assurance, where insurance and an emergency cushion secure your family and income. Next is Accumulation, where mutual funds help you build consistent long-term wealth. The final step is Acceleration, where equity investing creates faster growth and long-term freedom. Protect first, grow steadily next, and multiply with smart equity decisions.

0

in wealth management

0

to financial freedom

0

to be freedom planners

Trusted by Leaders We’ve partnered with leading organizations to provide financial education, coaching, and wealth solutions.

FAQ

Comprehensive financial planning, goal-based investing, SIPs, tax-efficient strategies, retirement planning, insurance advisory, and periodic portfolio reviews. For business owners, we also advise on treasury and risk management.

Individuals, families, and business owners who want a structured plan for goals like education, home purchase, retirement, and wealth transfer. First-time investors and experienced investors are both welcome.

We use a goals-first, risk-managed approach. Portfolios are diversified across asset classes and rebalanced periodically. We avoid timing the market and focus on cost, tax efficiency, and staying invested.

Book a discovery call, complete a risk and goals questionnaire, share KYC and current holdings, and we’ll propose a plan with next steps and timelines.

SIPs can be modified, paused, or stopped. Redemptions depend on fund cut-off times and any exit loads or lock-ins (e.g., ELSS has a 3-year lock-in).

Testimonials

Real estate has been my passion for years, and investing in land always felt natural to me. However, after diversifying into stocks and mutual funds through Money At Work, I’ve experienced remarkable growth in my overall portfolio. Their well-researched strategies, transparent guidance, and client-centric approach have added substantial value to my wealth-creation journey. I have complete trust in their expertise and highly recommend Money At Work to anyone seeking a professional and confident path to building wealth.

Paresh Thakkar

As someone who travels frequently, having a dependable financial advisor is truly a blessing. Investing with Money At Work has been a smooth and stress-free experience from the very beginning. Their guidance is practical, transparent, and always focused on long-term wealth creation. They handle everything—from insurance to SIPs—with complete professionalism, allowing me to stay worry-free while I’m on the move. I genuinely trust their expertise and highly recommend Money At Work to anyone seeking reliable and straightforward financial advice.

Yogesh Thakkar

Working with Siddharth Thakkar has genuinely strengthened my financial journey. He takes the time to understand my goals and provides clear, personalized strategies that balance both short-term needs and long-term growth. His depth of knowledge—across stocks, mutual funds, insurance, and more—is matched by his genuine care for clients. Siddharth makes complex concepts easy to understand, helping me make confident, informed decisions. I highly recommend him to anyone looking for a trustworthy and truly client-focused financial advisor.

Hemal Thakkar

I spent years focused only on trading, convinced that investing wasn’t for me. Money At Work opened my eyes to a completely different financial world. Their guidance helped me break old myths, understand long-term investing, and build a portfolio that actually grows with time. This shift has been life-changing. Money At Work is the perfect partner for anyone ready to think bigger, invest smarter, and create wealth that lasts.

Dhruvil Shah

The best part I admire is the win-win solutions which they have come up. They are more focused on growing along with the clients rather than growing at the cost of the clients.

Dr. Manubhai Katakiya

One important thing I have learnt from them is that the mindset of an investor is as important as the knowledge of the investor. Most consultants focus on knowledge and past results. Here mindset is also developed. That makes a lot of difference.

Mr. Mukeshbhai Surani

Blogs

Blogs

-

3 Simple Steps to Set Yourself Free!

Supported by a robust sales force and tight cost controls, Pharm Ltd.

-

5 Ways to Become a Crorepati

Everyone dreams of becoming a Crorepati one day! But how does one really achieve that goal? Let’s look at the five common ways people usually imagine building a crore.

-

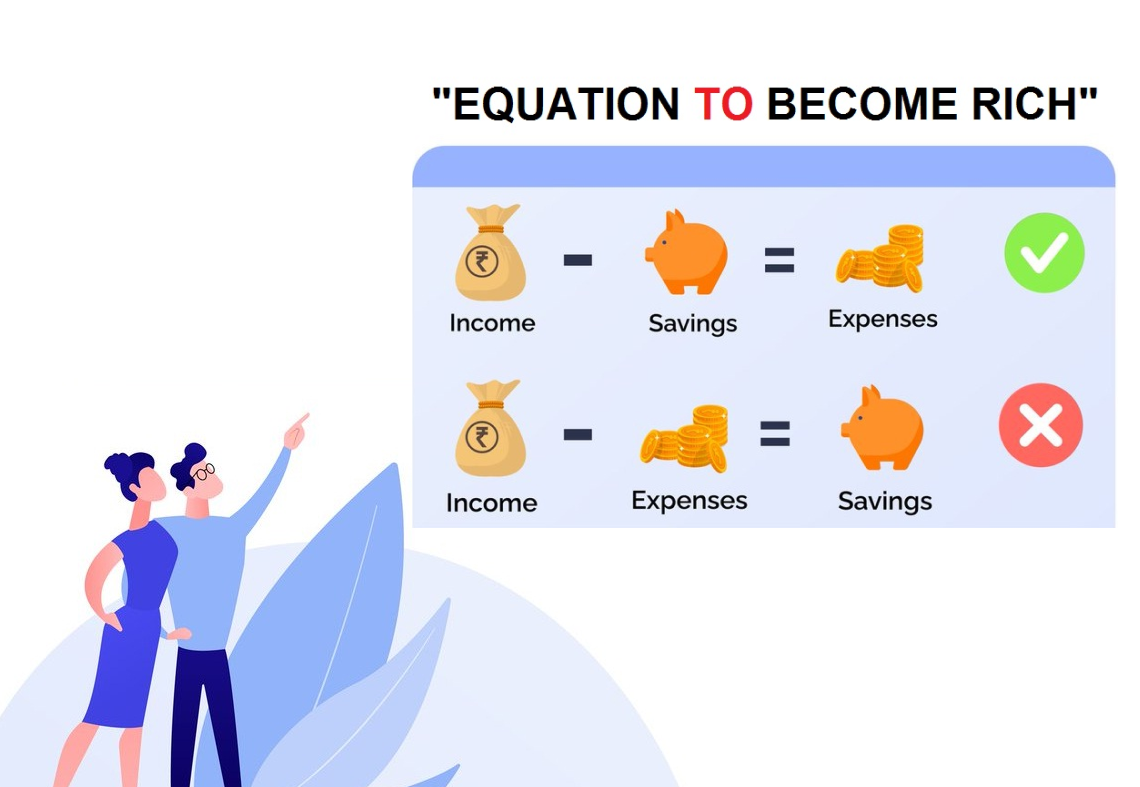

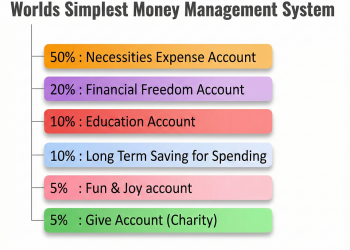

World Simplest Money Management System

If you want to grow rich, focus on earning, keeping, investing, and managing your money. Managing without a plan is like driving without direction — you move, but don’t reach anywhere.