5 Ways to Become a Crorepati

- April 2, 2018

- Posted by: admin

- Category: Competitive research

Everyone dreams of becoming a Crorepati one day!

But how does one really achieve that goal?

Let’s look at the five common ways people usually imagine building a crore:

- Getting Wealth in Inheritance

- Winning a Lottery

- Becoming a Celebrity

- Marrying a Rich Person

- Saving and Investing

Now, let’s be honest — the first four depend on luck or circumstances we can’t control.

But the fifth one —Saving and Investing — is completely in your hands!

And that’s exactly where your real journey to wealth begins.

The Simple Rule of Wealth: Spend Less, Save More

We’ve all heard the fitness mantra:

“Eat less and exercise more.”

Well, there’s a similar formula for financial fitness:

Spend less, save more, and invest wisely.

You don’t have to be a finance expert or have a high-paying job to become rich.

What truly matters is consistency — saving regularly and allowing your money to grow over time through compounding.

The Power of Compounding

Let’s understand this with a simple example:

You save Rs. 100 and earn 10% interest per year.

After one year → Rs. 110

Next year, 10% interest is applied on Rs. 110 → Rs. 121

And so on…

Your money starts earning interest on interest, and that’s what creates long-term wealth.

Over time, this simple concept turns into a snowball effect — your wealth keeps growing faster and faster.

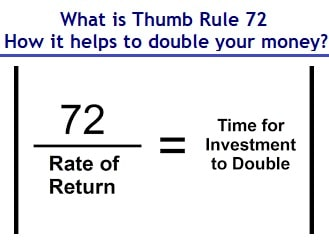

The Rule of 72 — Quick Formula to Double Your Money

There’s an easy rule in finance to know how long it will take to double your money.

Rule of 72 = 72 ÷ (Rate of Return)

If your investment earns 10% per year,

72 ÷ 10 = 7.2 years — that’s roughly the time it takes to double your money.

So, Rs. 1 lakh invested today at 10% will become Rs. 2 lakh in about 7.2 years,

Rs. 4 lakh in 14.4 years, and so on

That’s the power of compounding working silently in your favour

How Much to Invest to Reach 1 Crore

Let’s see how much you need to invest every month to achieve your financial goals (assuming 15% annual returns):

|

Desired wealth & amount to be invested per month |

|||||

|

Target for years |

5 lacs |

10 lacs |

20 lacs |

50 lacs |

1 crore |

|

5 |

5645 |

11290 |

22580 |

56450 |

112899 |

|

10 |

1817 |

3633 |

7267 |

18167 |

36335 |

|

20 |

334 |

668 |

1336 |

3339 |

6679 |

|

30 |

72 |

144 |

289 |

722 |

1444/- |

Start today!

Investing just Rs. 1,444 per month for 30 years at 15% return can help you build Rs. 1 Crore.

Why Starting Early Matters — The Story of Ajay

Meet Ajay, age 30, who wants to retire at 60.

If Ajay invests Rs.1,500 per month for 30 years at 15% return,

he’ll end up with around Rs. 1.03 Crore.

But if he delays and starts investing at age 50,

he’ll need to invest Rs.41,500 per month for the same Rs.1 Crore goal!

That’s the power of starting early — time multiplies your money.

Time in the market beats timing the market.

Start small, but start now.

Einstein Called It the 8th Wonder of the World

Albert Einstein once said:

“Compounding is mankind’s greatest invention.

It allows for the reliable, systematic accumulation of wealth.”

He even called it **“The 8th Wonder of the World.”**

And rightly so — because compounding rewards **patience, not perfection

Where Should You Invest?

In our examples, we assumed 10–15% returns.

Here’s a quick look at different investment options and their average returns:

Equity Mutual Funds / SIPs → 12–20% (long-term average)

PPF / PF / Fixed Deposits → 7–10% (safe & stable)

If you prefer safety, go with PPF or FD.

If you aim for higher growth, SIP in mutual funds is your best long-term option.

Action Steps to Benefit from Compounding

Here’s a quick checklist to start your wealth journey:

- Start Early – Even with a small amount, begin today.

- Invest regularly – Stay consistent with monthly SIPs.

- Don’t Withdraw Often – Let your money stay invested.

- Be Patient – Give compounding enough time to work.

- Increase Gradually – As your income grows, increase your investment.

Final Thought

You don’t have to be born rich to become rich.

You just need to start early, stay consistent, and be patient.

Even if you start with Rs. 500 or Rs. 1,000 a month

your money can grow into something truly big — thanks to the power of compounding.

Those who start early, finish rich.

Disclaimer

The information shared in this article on Money At Work is for educational and informational purposes only. It does not constitute financial, investment, or professional advice. Investment options, returns, and risks vary for every individual depending on personal goals and market conditions.

Before making any financial decisions, please consult a certified financial advisor or planner to determine what’s best suited for your needs.

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.