3 Simple Steps to Set Yourself Free!

The Art of simplicity leads to path of financial freedom.

Freedom isn’t just about living in an independent country — it’s about living life on your own terms.

Imagine waking up one morning without worrying about EMIs, bills, or the next big expense.

That’s not just peace of mind — that’s financial freedom.

While we celebrate national freedom once a year, personal financial freedom is something we must build every single day.

So let’s talk about what it really means to be financially free — and the 3 simple steps that can help you get there.

- Step 1: Define Your Freedom List

Before you start chasing wealth, ask yourself — what does “freedom” mean to you?

Create your Freedom List — your top 3 goals that define financial independence in your life.

Your list could include things like:

- Retiring early with peace of mind

- Educating your kids debt-free

- Buying a dream home or being completely loan-free

Keep it short. Keep it real.

Freedom is personal — make it yours.

- Step 2: Quantify Your Freedom Goals

A goal without numbers is just a wish.

Take each goal and give it a value and a timeline.

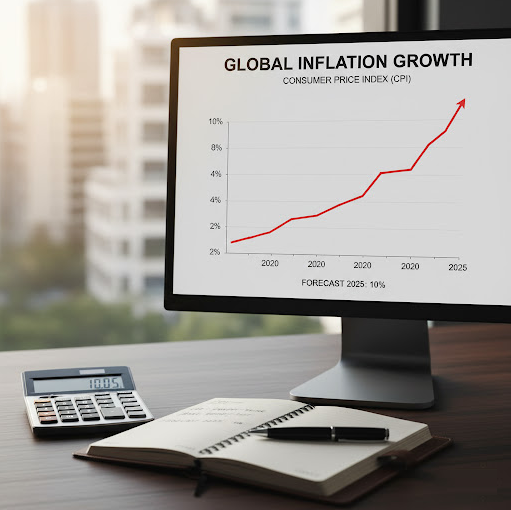

Inflation quietly eats into your dreams — so plan ahead.

Estimate future costs using a 10% inflation rate and decide how much and by when you want to achieve it.

Once you attach numbers, your dreams transform into targets.

- Step 3: Save, Invest, and Stay Consistent

Your plan will only work if your discipline does.

Start small, stay consistent, and let compounding do its magic.

For example:

-

Short-term goals (1–3 years): Debt or fixed income options

-

Medium-term (3–7 years): Mix of equity, debt, and gold

-

Long-term (7+ years): Focus more on equity, with some debt and gold for stability

Market ups and downs will come and go — but remember, freedom is built over time, not overnight.

Final Thought

Financial freedom isn’t a destination — it’s a way of living.

It’s about knowing that your money is working for you even when you’re not.

Start with clarity, stay consistent, and trust the process.

Because real freedom begins when your money stops needing you.

Here’s to a future where your dreams are debt-free, your wealth is growing, and your life feels truly independent. Wishing all our readers a happy and financially free life!

— Team Money at Work

MEET AN INVESTMENT CONSULTANT

Decisions about your financial goals such as retirement, childs education, house purchase etc

can be worrisome, but with the help of one of our Investment Consultants, it need not be.

To make an appointment with one of our Consultants, simply Contact Us

Disclaimer

The information shared in this article on Money At Work is for educational and informational purposes only. It does not constitute financial, investment, or professional advice. Investment options, returns, and risks vary for every individual depending on personal goals and market conditions.

Before making any financial decisions, please consult a certified financial advisor or planner to determine what’s best suited for your needs.